PLG and layoffs: are product-led or sales-led companies more resilient?

.png)

.png)

A lot has been written about the impact of PLG (product-led growth) in tech. But what about the composition of product-led teams themselves? How do they fare when the economic tides turn, such as they have in the last year?

In 2022, 1,045 tech companies laid off 160,097 employees, according to Layoffs.fyi, a project that’s tracked layoffs since the beginning of the COVID-19 pandemic.

The layoffs signaled that “growth at all costs” may very well have been a zero interest rate phenomenon.

Investors want to see profitability and controlled growth. For overextended companies, layoffs were the most expedient way to reduce burn rates and become “default investable.”

While there’s so many questions that need answering about this economic downturn and the resulting carnage in the tech space, we had some specific questions about our own customer base and audience. Namely:

Our hypothesis: Product-led companies would have fewer layoffs than sales-led companies.

To answer these questions and test our hypothesis, we looked at companies that did layoffs in 2022 by grouping them into 2 buckets: product-led (where the product is the primary means of customer acquisition, expansion, and retention) and sales-led (where sales and marketing are the primary means of those same activities). We then looked at the magnitude of layoffs between each bucket.

Using layoff data from Layoffs.fyi and a list of product-led companies from Peer Signal, we found that the total number of layoffs and average layoffs as a percentage of company size for product-led companies was less than sales-led companies for the period included in the data set.

PLG companies’ primary growth driver is the product itself. The product facilitates a self-serve user journey through every stage of the customer lifecycle—from discovery and evaluation, to acquisition and expansion—with lesser involvement from traditional sales teams.

Sales-led companies’ primary growth drivers are sales, marketing, and customer success/account management teams; i.e., growth is a top-down function of these roles. SLG companies invest in these functions to educate, acquire, and grow customer accounts. Each team “owns” the customer relationship at different phases of the customer lifecycle.

Many companies don’t fit into neat boxes labeled “PLG” or “sales-led.” PLG companies often have sales/customer success teams to facilitate larger deal sizes, while SLG companies can use classic PLG techniques like free trials, monthly billing cycles, etc., as acquisition plays.

For the purpose of our study, however, we had to simplify things a bit to get a usable dataset for each group. If a company had a free trial offer on its website, we classified them as product-led. Those without were classified as sales-led.

Peer Signal data does not contain data on companies’ total number of employees, or the number of employees laid off. Therefore, we could only calculate the delta of year-over-year employee growth as a percentage.

Layoffs.fyi data contains the number of employees laid off but no total number of employees. It shows the number of employees laid off as a percentage of the total number of employees. Thus, we could get data on the number laid off, but do not have corresponding data for the percentage decrease.

This means that the PLG data is expressed only as a year-over-year delta in employee count, while the delta in SLG companies is a percentage of the total employee headcount.

Knowing that product-led companies made fewer layoffs as a percentage of their employee base, the next question is, “Why?”

While this would probably call for a completely separate study, we can make some educated inferences based on what we already know about product-led and sales-led companies.

Because PLG companies make it easier to try their products, generally offer monthly contracts, and tend to cost less, they attract a wider base of free and paying customers. Sales-led companies’ products tend to be higher cost with longer buying cycles, meaning their contract sizes are bigger at the top end but fewer in number than PLG.

During a downturn, PLG companies are likely cushioned from the impact of their customers cutting costs. A low-cost SaaS product that’s useful to an org will likely escape significant budget cuts, even if customers reduce their number of seats. A big-ticket product from a sales-led company could be a more likely target for customers in dire financial straits. When high ACV customers start making cuts, sales-led companies will feel it more.

The common way of thinking for sales-led companies is that if things aren’t going well, the first step is to cut the lower performing sales reps and pull back on marketing spend. In general, it’s easier to rehire sales and marketing than it is to hire engineers and developers in a competitive market.

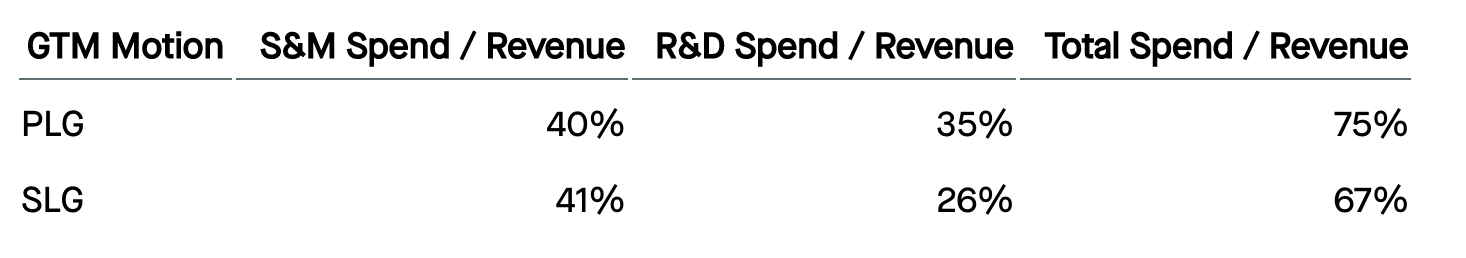

Product-led companies, by contrast, invest more in engineering and R&D activities. Data from venture capitalist Tomasz Tunguz shows that PLG companies spend 9 more percentage points of revenue on R&D than sales-led companies.

These investments are much harder to cut because, by definition, the product drives everything for them. Cutting back on innovation here can lead to some negative downstream effects—everything on the product roadmap gets delayed, which impacts your go-to-market activities and ability to retain customers. Thus, layoffs would not always be the best way to reduce burn rate.

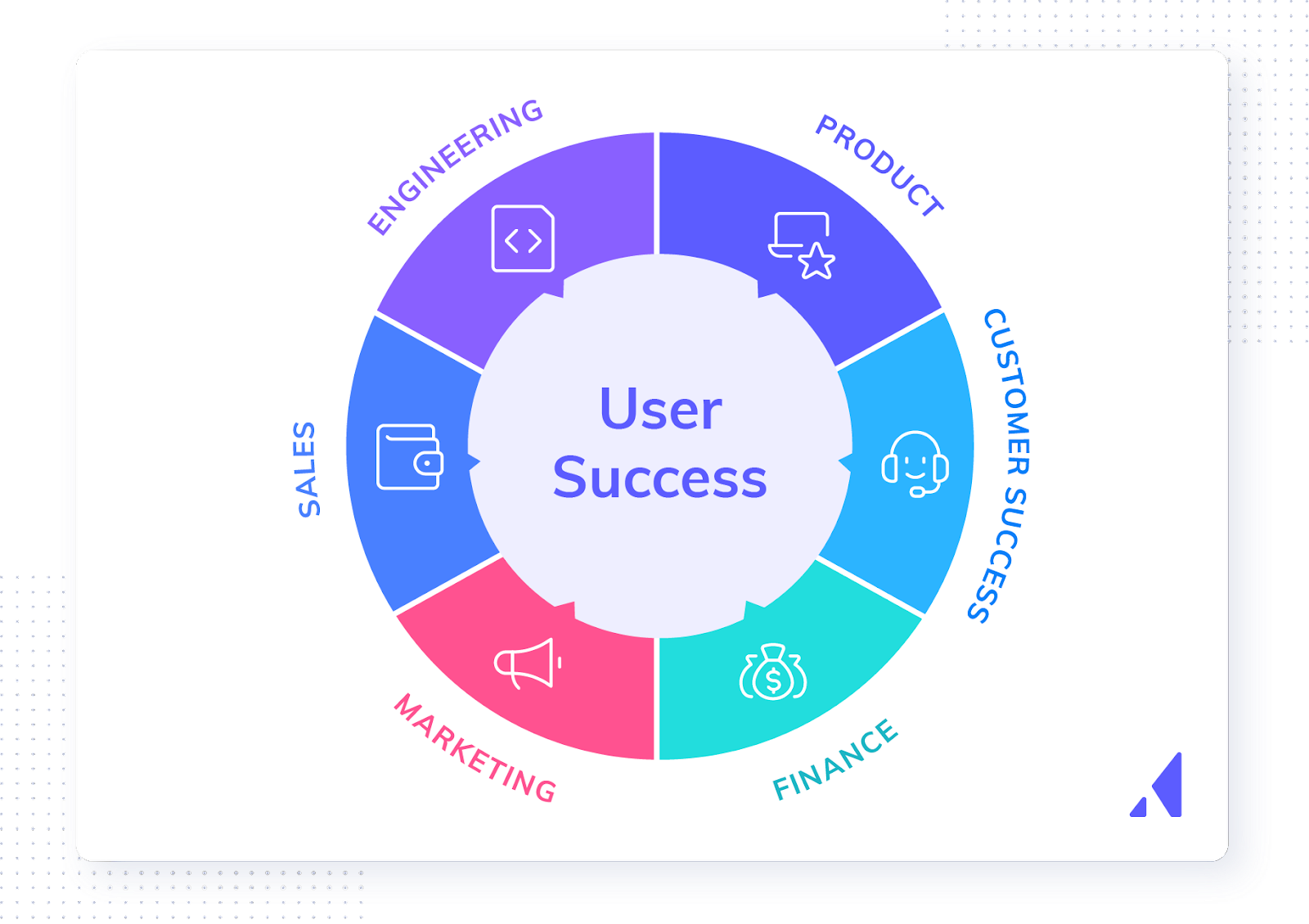

Because the product is the main driver of the customer lifecycle in a PLG company, many of the functions that fall to different teams in a sales-led org are handled by the product itself. At a high level, every team in a PLG company is tasked with driving user success and positive outcomes in a one-to-many fashion, rather than on a customer-by-customer basis.

Great PLG companies—think Slack, Atlassian, Airtable, Notion, and the like— use their products to attract, onboard, and support customers without ever requiring them to talk to a person. They do this through a combination of documentation, in-app education, and intuitive UX.

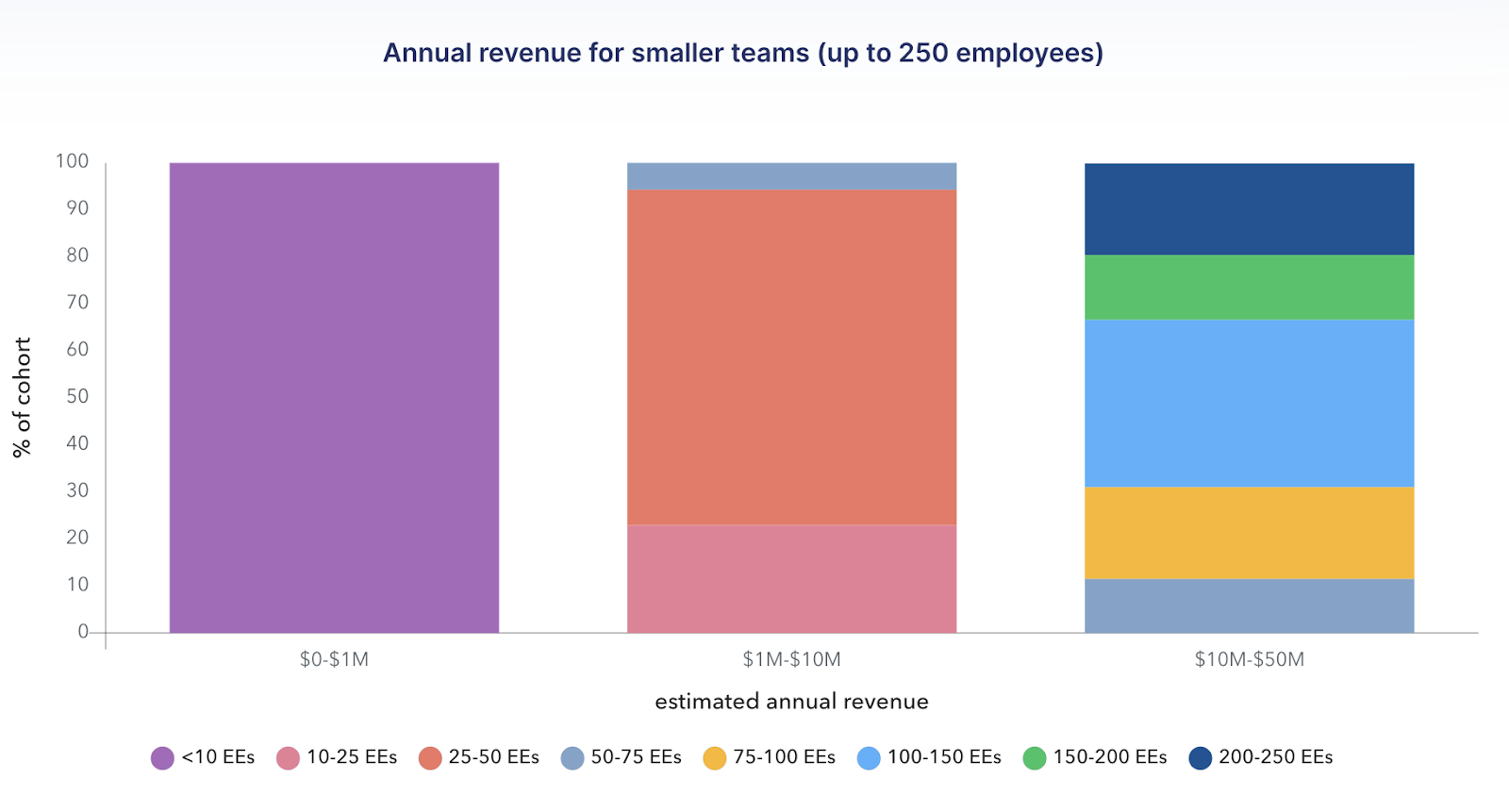

PLG companies can serve more customers with smaller teams, thereby reducing their Cost of Goods Sold (support and account teams are normally folded into COGS) and free up resources to invest back into the product. Data from a 2020 study that Clearbit conducted confirms this:

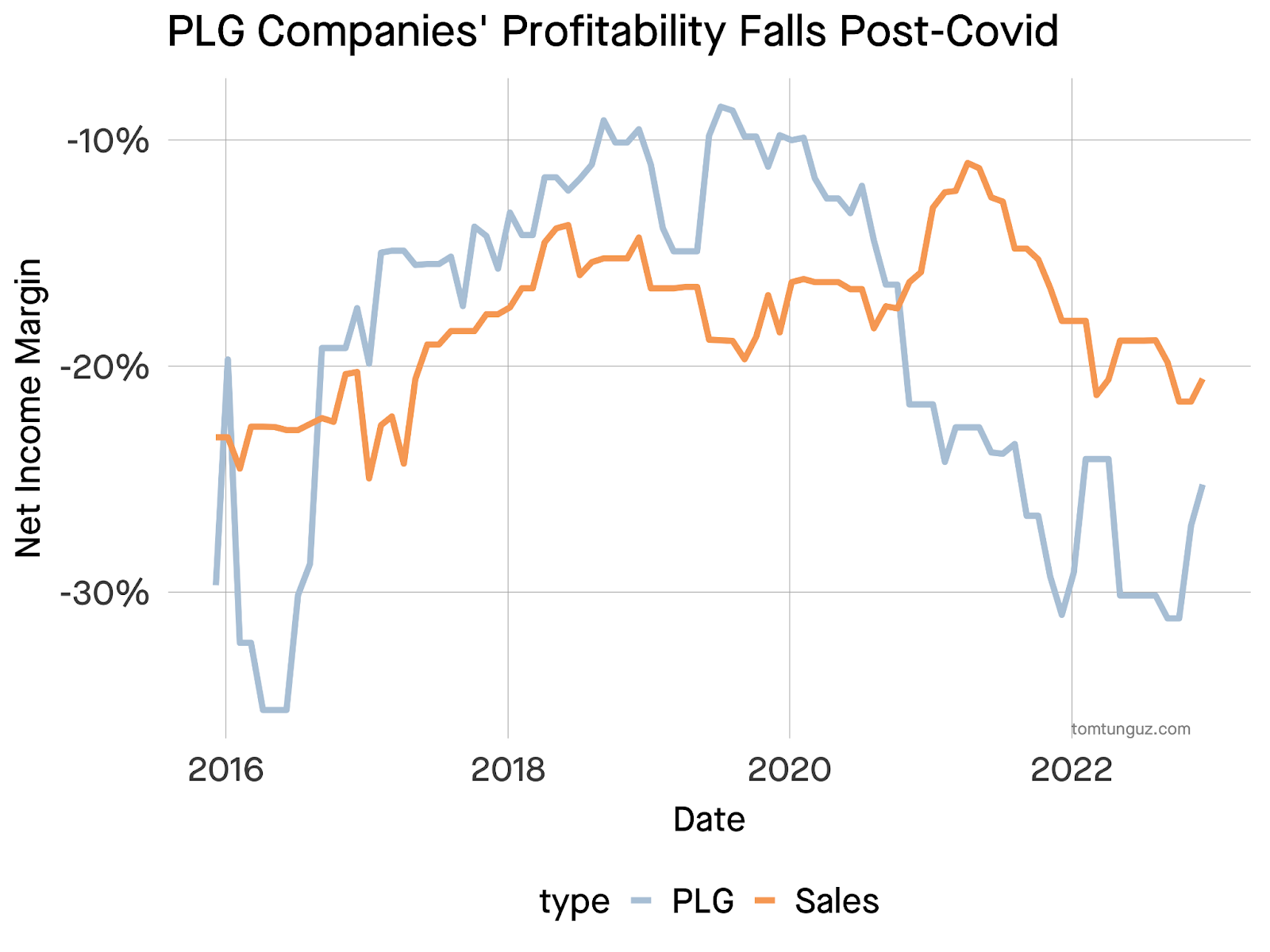

It’s important to understand the wider context of SaaS over the last 3 years. Between COVID, supply chain disruptions, and the volatile macroeconomic environment, the calculus of PLG has changed. Specifically, product-led companies are now less profitable on average than their sales-led counterparts.

Source: PLG & Profitability : More Product Doesn't Necessarily Mean Greater Profits

As Tom Tunguz pointed out, since 2020, dollars invested in R&D haven’t produced new business at the same rate as dollars invested in sales and marketing at product-led companies.

It may be true that product-led companies need to reallocate resources and put them toward lowering CAC. But the layoffs data shows that while PLG profitability has declined, these companies have weathered the downturn in capital markets better than sales-led companies.

The lesson for both types of companies is clear: PLG and sales-led growth shouldn’t be seen as mutually exclusive. Finding the right mix of both ways to serve customers will be vital for moving through tough economic times and driving net income growth.

Sales-led company management teams need to look for ways to drive efficiencies with their products, while PLG leadership should evaluate their R&D investments and see if those dollars would have more yield if they’re invested in sales and marketing.

As more companies’ product experiences digitalize, adopting product-led thinking can benefit companies of all stripes. Looking to get started? Check out the Product-Led Growth Collective today.