How to calculate customer retention rate

.png)

.png)

The old saying, “You can’t please all of the people all of the time,” is definitely true in business. Sometimes, your product won’t meet the customer’s needs, and they’ll drop off.

But knowing that you’ll inevitably lose customers doesn’t mean that you should ignore your customer retention rate (CRR). After all, customer retention is key to your company’s growth.

But customer retention rate can be tricky to calculate and apply to your business.

B2B businesses need to pay special attention to their retention rate, since they have especially long relationships with customers. To get the most out of your customer retention rate, you’ll need to make sure you know:

If you nail these three factors, you’ll have a clear picture of the current state of your B2B company and be better equipped to set up your product for long-term success.

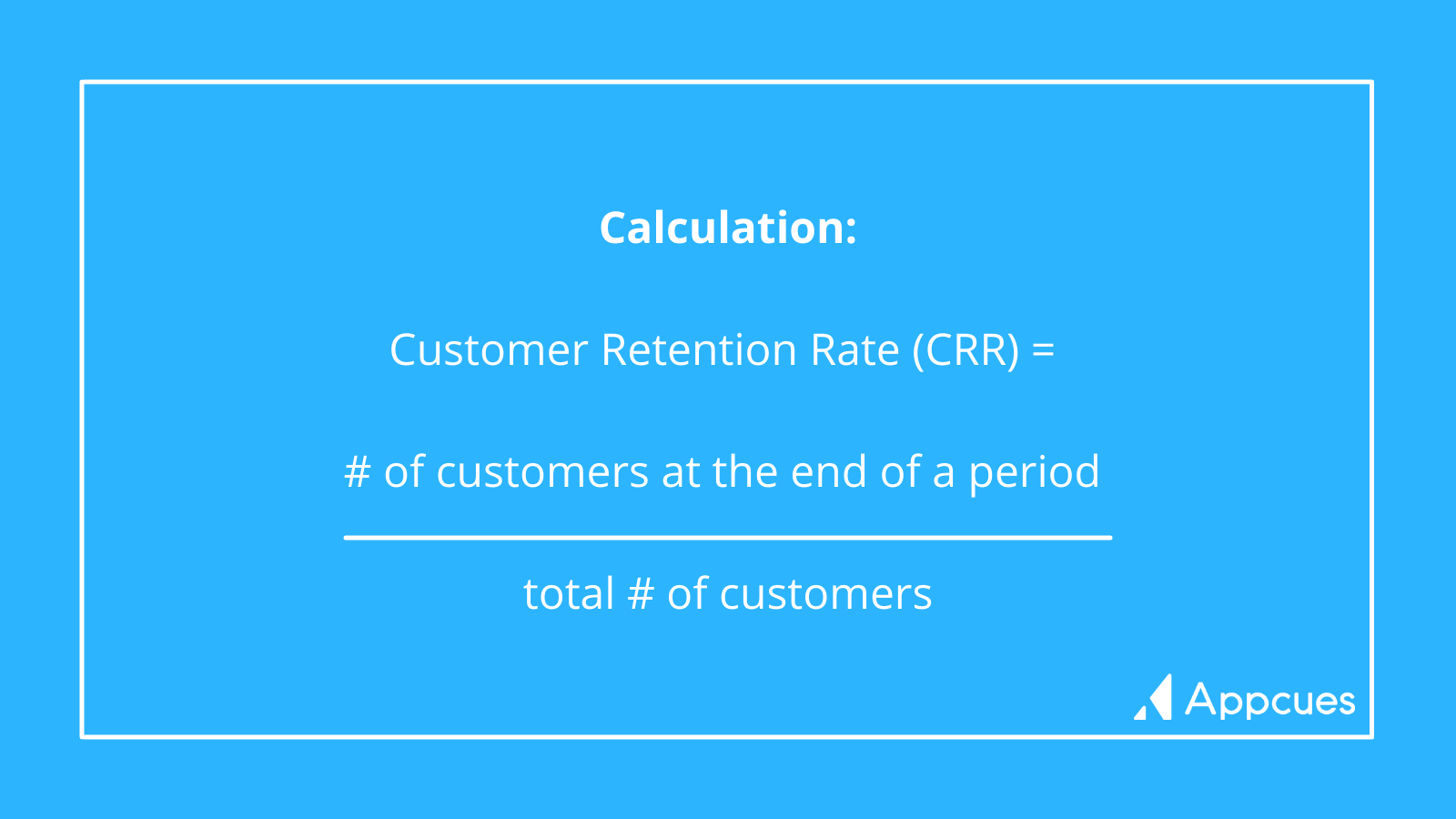

The formula to calculate customer retention rate is straightforward.

Customer retention is incredibly important and slightly different from user retention rate. For the purpose of this article, “customers” means subscribed users. To fall into this category, a user must be subscribed to your product, and have made at least one payment (if you're offering a paid service).

With this in mind, here are a few things to note:

ProfitWell notes a few key considerations for B2B businesses managing retention rate. On one hand, B2B businesses have to appeal to entire teams to keep their retention rate high. If your tool doesn’t help people do their jobs better, you risk losing a whole company of users—not just a single customer.

You’re also often operating in a smaller, more niche market than most B2C companies. This factor makes losing teams of users all the scarier.

On the upside, B2B companies often have long, high-value contracts—especially in SaaS. So, while your churn hits harder, the payoff of the customers you retain tends to be higher than in B2C.

What gets measured, gets managed. To improve your overall customer retention, you first have to measure it precisely, and in a way that makes sense for your business model. For example, looking at your customer retention rate quarter over quarter doesn’t make sense if your subscriptions or contracts are lengthy. Here are three tips for making sure your CRR is set up correctly.

So, what is a good overall customer retention rate? What is the percentage of customers that you can expect to churn within a particular time frame? This depends on two factors:

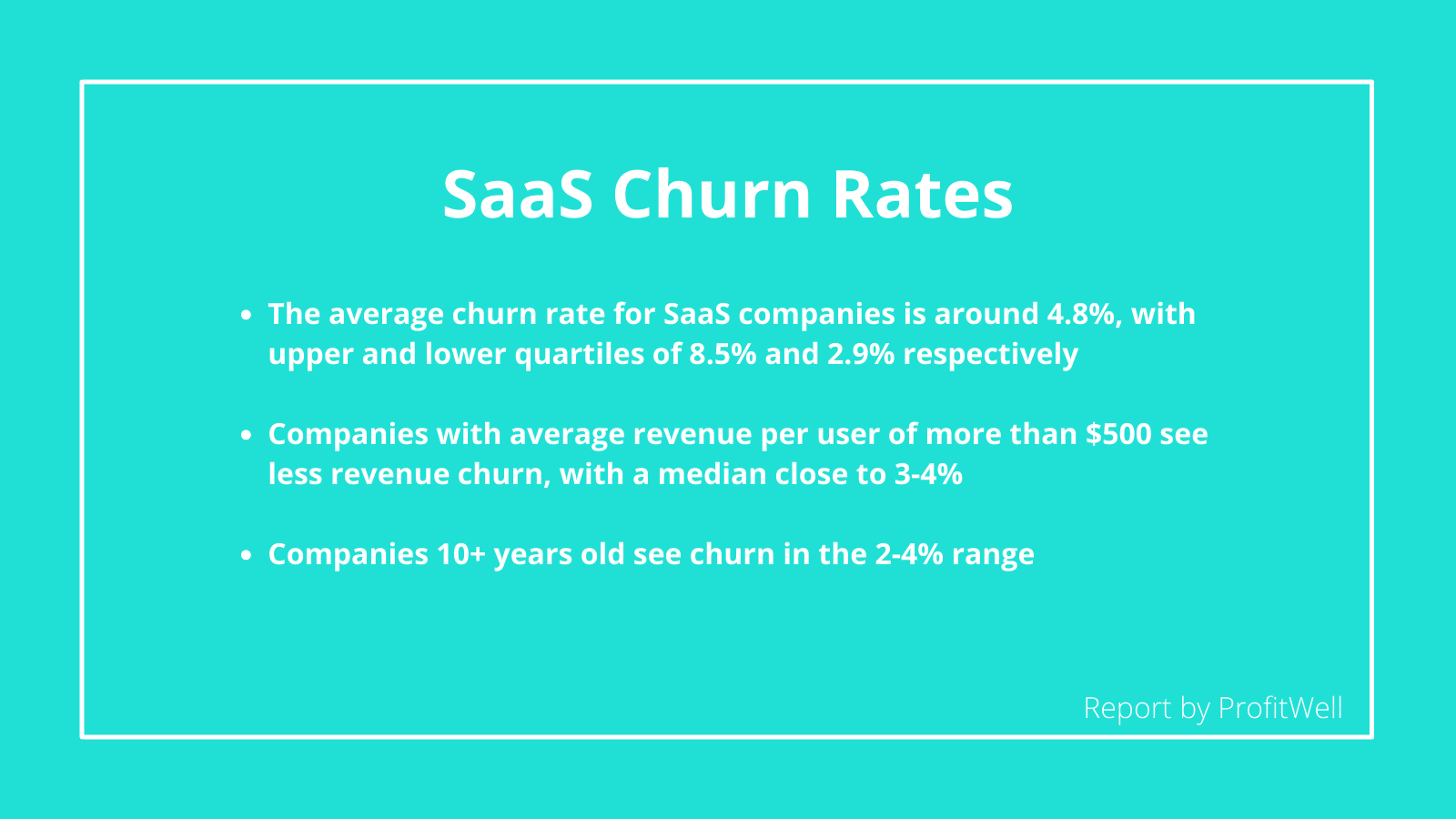

If you don't have significant retention data yet, you can also compare to benchmarks. According to a Pacific Crest survey, 70% of B2B SaaS companies had an annual churn of less than 10%.

There is some correlation between the age of the company and monthly recurring revenue with overall churn, according to a report by ProfitWell. Companies with a higher average revenue per user see much lower churn. Companies with contracts longer than a year experience lower churn rates than those who offer monthly contracts.

Hitting these numbers takes time. If you're still in year 1 or 2, don't fret if you're not hitting these metrics yet.

It’s all well and good to start comparing graphs from different time periods, but knowing the right comparisons to make will help you gain valuable insight and reach your goals faster. Here are the comparisons you should be making and why:

When it comes to deciding how long a period you should measure, take into account the age and stability of your company. If you've had a stable customer retention rate for a few years, you can compare year to year to see whether there are long-term improvements. But if your business is only two years old, it doesn't make sense to attribute notable changes to anything more than the natural maturation of your startup. In this case, shorter time periods will be your only option until you have more longevity.

Whether you’re a B2B or a B2C company, you’ll need a way to track your customers in order to calculate CRR.

The right customer tracking will help you set accurate retention expectations and find ways to improve your retention efforts.

Whether B2B or B2C, your customer retention strategy requires departments to work cohesively to support the customer. Your marketing, customer service, and product development teams need to understand the reasons for churn in order to best focus your efforts on how to improve your overall customer retention.

Some strategies include:

Keep in mind that you’re not going to see an immediate impact on customer retention. You may not be able to pull back customers who are already on the fence, but your efforts will be an investment in future customer retention.

Understanding how to calculate customer retention is step one in helping you determine the urgency of a churn problem. From there, the biggest factor in improving customer retention is understanding the reasons that you’re losing customers. Part of your ongoing tracking should include identifying why different customers have churned and looking for patterns. Knowing how to apply the right strategies will be the true measure of improving your customer retention.