The fastest-growing startups have the easiest products to use. Here’s why

.png)

.png)

The best products break down barriers and enable growth. It’s what’s transformed the cloud software industry into a $172 billion behemoth in just a handful of years.

Teams looking to emulate that success, take note: The fastest-growing SaaS companies are generally those with the easiest-to-use products, according to data we analyzed from Peer Signal and G2, 2 businesses compiling data points on software products and market data.

Let’s break down why. Spoiler alert: the rise of product-led growth (PLG) plays a big part.

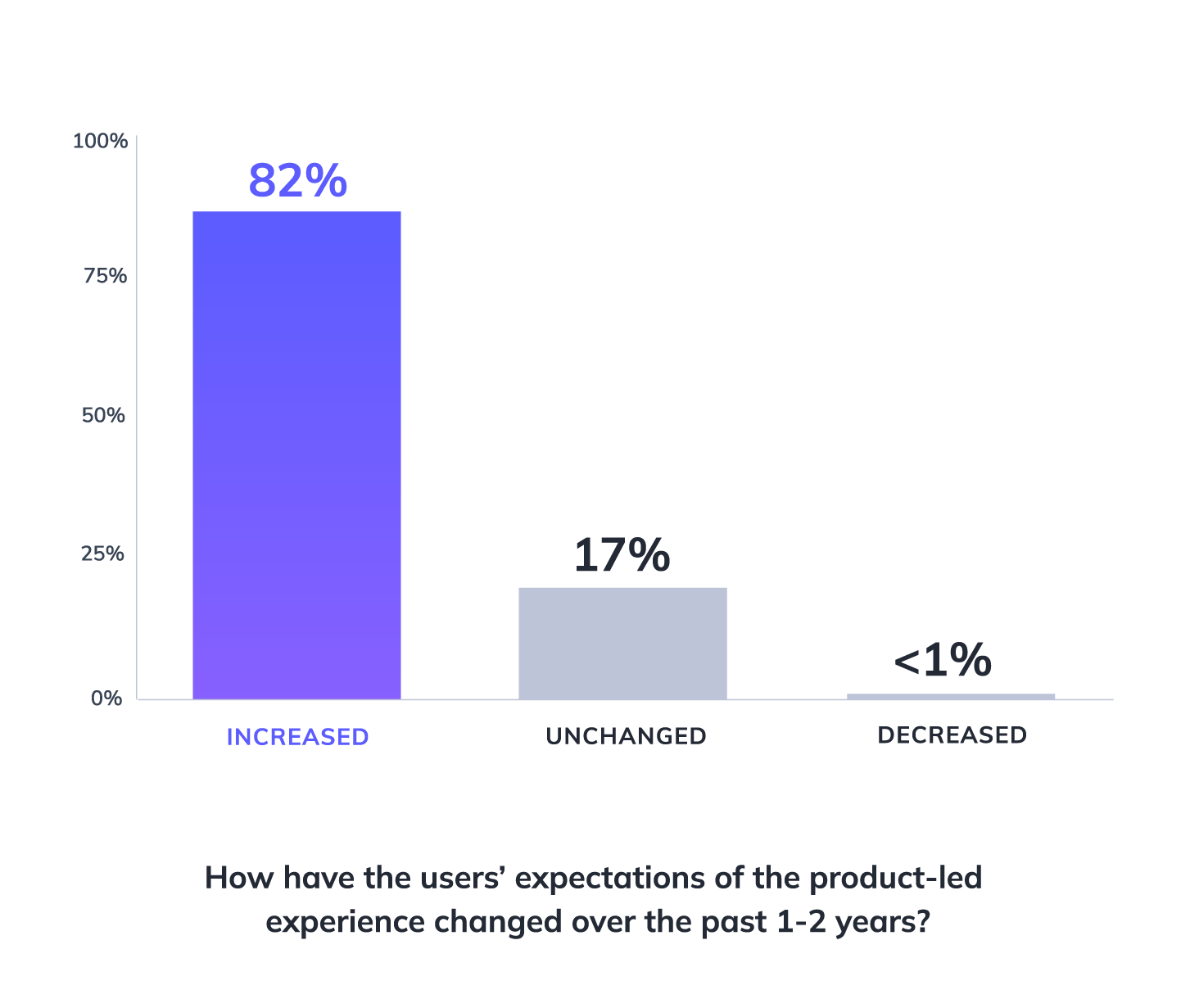

The way people buy software is changing. In fact, in our recent survey of 350 SaaS professionals, 82% believe that product-led experience user expectations have risen in the past 2 years.

In a product-led world, it makes sense that startups built for free trial and self-serve users would have a leg up.

Data we’ve analyzed suggests just that: a positive relationship between product usability and growth at some of the top SaaS companies. Put another way—those that create the best experience for users are generally thriving.

“Today, people want to experience the value of a product before they buy,” Ramli John, Appcues Director of Content Programming, says. “Products that are easy to ‘try on before you buy’ make for a superior user experience.”

So, how did we reach this conclusion?

We looked at data on the 40 fastest and 40 slowest-growing companies in SaaS and checked for factors like G2 usability and quality scores, growth stage, and employee headcount growth. In our findings, growth came down to 3 key factors that supported the best possible user experience:

Yes, companies in the growth stage tended to add a lot of employees year over year. And newer companies often grew faster.

But were either of those the most important factor in overall employee headcount growth?

Not even close—not according to our data.

Instead, higher scores on our 3 key metrics were tied to faster employee growth.

On average, the 10 fastest-growing SaaS companies were rated 92.6 out of 100 for ease of use.

For customer support, that figure was 93. And it was 91.3 for ease of setup.

Compare that to the 10 slowest-growing SaaS companies:

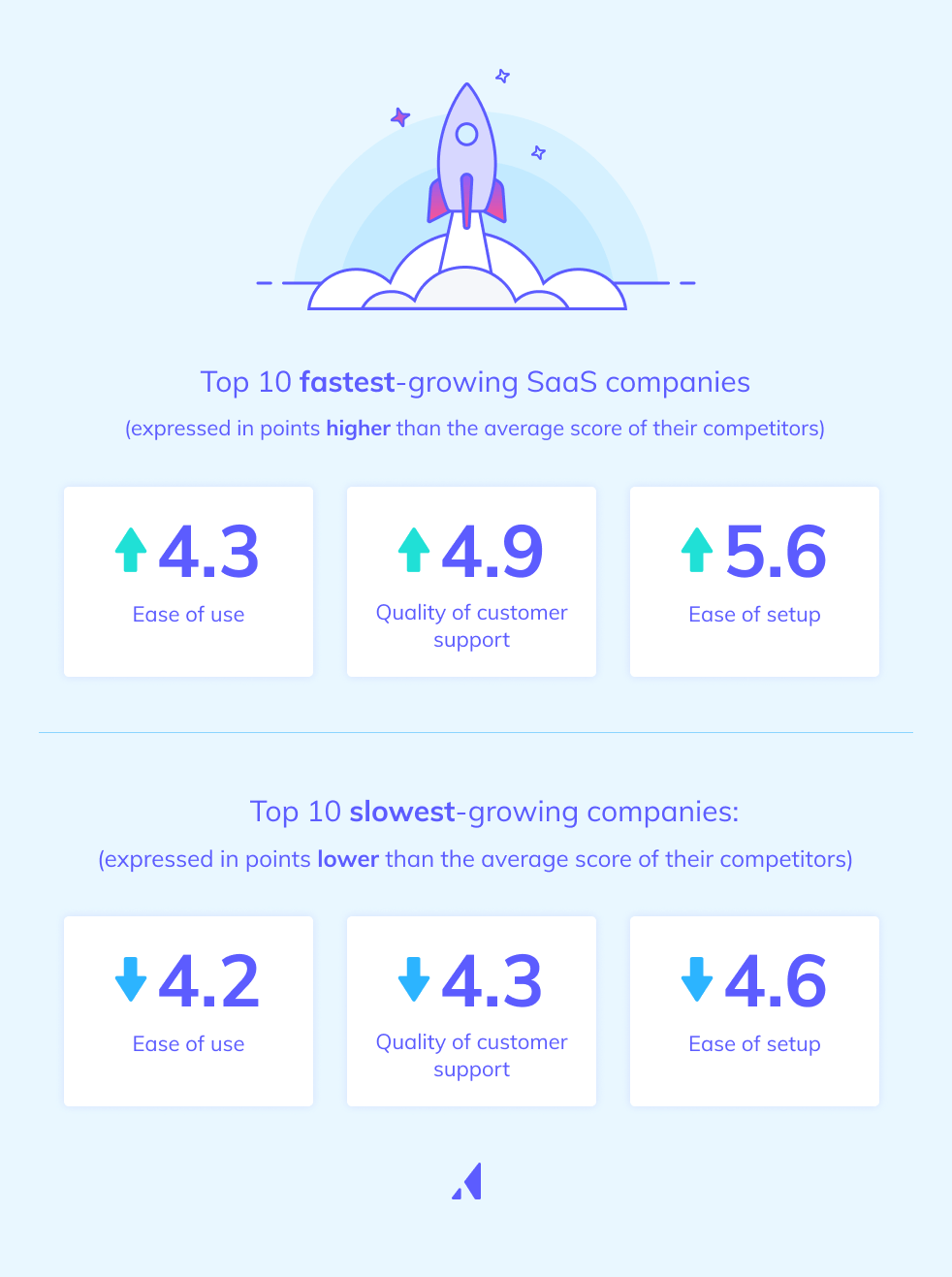

It wasn’t all about raw scores, though. Growth was also about how well SaaS companies performed in relation to their direct competitors (those in their same product category on G2).

In fact, the importance of ease of use, customer support/success and ease of setup in unlocking growth became even more clear when we looked at how the fastest- and slowest-growing SaaS companies performed in relation to their competitors.

Here’s the breakdown for the top 10 fastest-growing SaaS companies (expressed in points higher or lower than the average score of their competitors):

And for the 10 slowest-growing companies:

TL;DR: The fastest-growing SaaS companies performed 4 to 5 points better than their competitors on average in all 3 factors. And the slowest-growing companies performed 4 to 5 points worse than the average among their competitors.

While we think the connection is best understood in the aggregate, here are a few random company-specific data points we analyzed for this study:

A SaaS platform that automates security controls for various compliance and data laws, Drata is the poster child for our study.

The growth-stage company scored unbelievably well for all 3 categories and blew competitors out of the water for each.

Meanwhile, its YoY employee headcount growth was 362%.

Scratchpad is a super interesting SaaS company with a micro focus: enabling sales and RevOps to update Salesforce faster.

They’re definitely doing it right. With all-green metrics for ease of use, CS and ease of setup, this is a venture-stage example of our thesis tying growth in SaaS to user experience.

In a single year, Scratchpad increased its employee headcount by a whopping 192%.

Firmex is a provider of virtual data rooms meant to enable secure sharing of documents across company firewalls. This growth-stage company was one of those demonstrating the opposite effect, where a lower ease of use score relative to direct competitors also yielded less growth than others in our data set at just 5%.

For those looking to dive into the data, you can do so here.

In terms of sourcing, we brought together 2 key data sources:

We got employee headcount growth, year founded, and growth stage from PeerSignal, and scores for ease of use, CS, and ease of setup from G2.

We looked at all of that for the 40 fastest-growing SaaS companies and the 40 slowest-growing SaaS companies—80 in total.

Then, we did a little math. We compared each company’s scores for each of our 3 primary categories to the average of companies within their product category on G2.

So, what does it all mean? Will building the simplest product ever just explode your growth overnight?

We wish—but there’s no one silver bullet behind growth in software.

But in an environment where more of the top SaaS innovators are growing with product-led go-to-market strategies, building intuitive products isn't just good for users—it's also good for business.